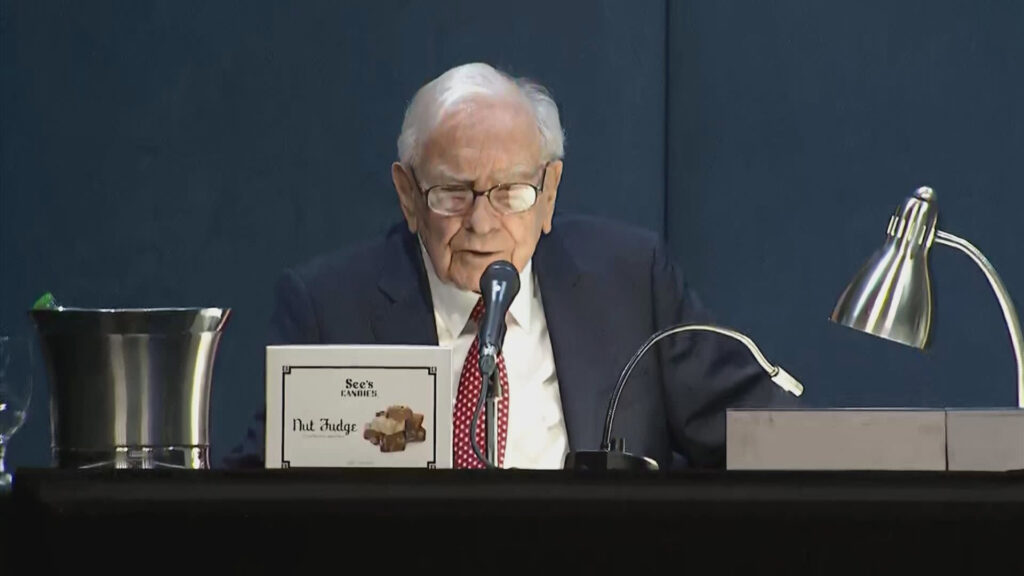

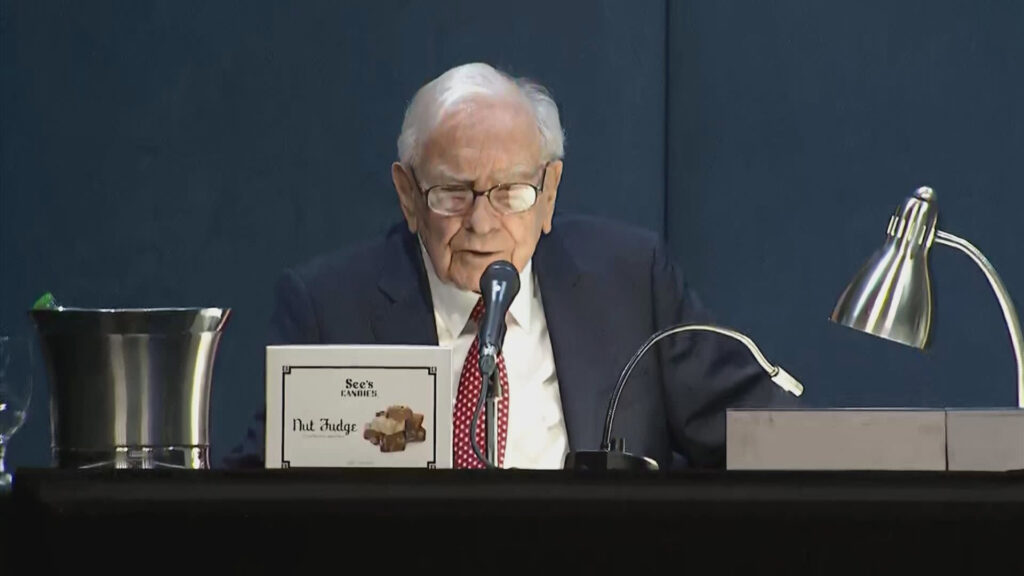

Berkshire Hathaway looks like an attractive investment, according to Argus. The research firm upgraded the Warren Buffett-led conglomerate to buy from hold. Analyst Kevin Heal also set a target price of $450, implying that Class B shares could rise 11% from their Tuesday close. “On valuation, the stock is trading at 21-times our 2024 operating EPS forecast, below the current S & P 500 multiple of 24-times,” Heal wrote. This discounted valuation comes even as Berkshire Hathaway Class A shares are up 12% for the year, outpacing the broad market index. Heal pointed out that Berkshire has consistently shown strong performance, with its stock returns doubling those of the S & P 500 since 1965. Meanwhile, the company’s financial strength remains high, with the analyst pointing to Berkshire’s cash position and equity investments of $188 billion and more than $330 billion, respectively, as of March 31. Berkshire recently revealed Chubb as the confidential stock it had been buying for several quarters. The company’s stake in the insurer was worth more than $6 billion at the end of the first quarter. To be sure, Heal pointed to several risks Berkshire faces, including the cyclicality of many of its fully-owned businesses.