Victoria Klesty | Reuters

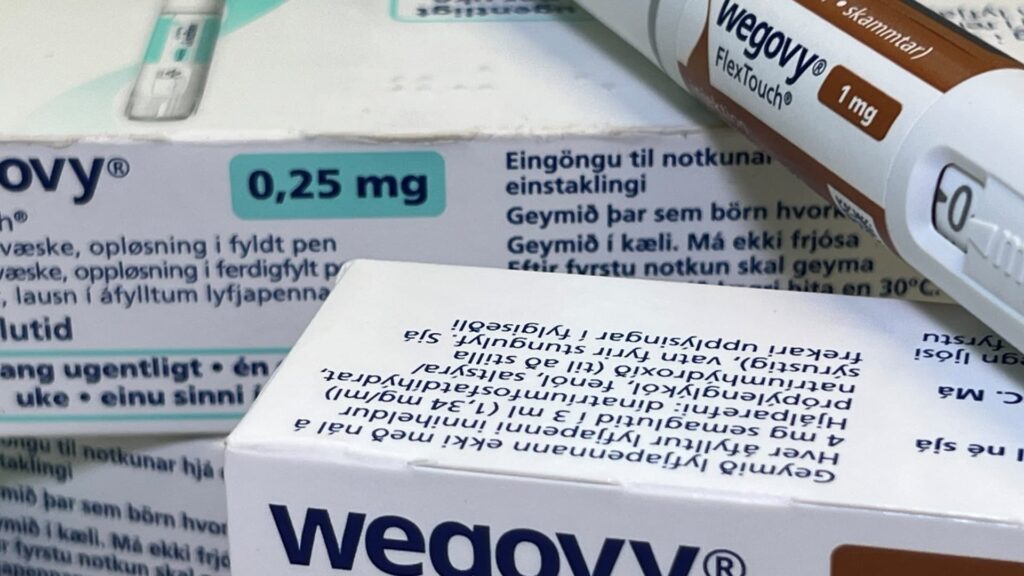

In the U.S., Wegovy is no longer just for weight loss.

The blockbuster drug — one of a handful of weight loss treatments to skyrocket in popularity over the last year — is now approved in the U.S. for heart health, too. But that may not translate to wider insurance coverage of the weekly injection drug from Novo Nordisk and similar obesity treatments just yet.

Some employers and other health plans are still reluctant to cover Wegovy due to its hefty $1,350 monthly price tag, which they say could significantly strain their budgets. They also have other questions, such as how long patients actually stay on the treatment.

At the very least, some plans will take notice of Wegovy’s new approval and start assessing whether to cover the treatment when they next update their formularies, some insurance industry experts told CNBC. That could mean difficult decisions ahead for insurers and likely a patchwork system of coverage for Americans who are seeking treatment to navigate.

“The more benefits that come from weight loss drugs, I think the greater the pressure is going to be to start including those drugs in a formulary and cover them in standard insurance plans,” said John Crable, senior vice president of Corporate Synergies, a national insurance and employee benefits brokerage and consultancy. “But my gut tells me it’s going to take more to convince some insurers.”

Wegovy is part of a class of drugs called GLP-1s, which mimic a hormone produced in the gut to suppress a person’s appetite and help regulate blood sugar. Coverage for those treatments when used for weight loss is a mixed bag.

Roughly 110 million American adults are living with obesity and approximately 50 million of them have insurance coverage for weight loss drugs, a spokesperson for Novo Nordisk said in a statement. The company is actively working with private insurers and employers to encourage broader coverage of those drugs, and is advocating for the federal Medicare program to start covering them, the spokesperson added.

The Centers for Medicare and Medicaid Services is reviewing the FDA’s expanded approval of Wegovy and will share additional information as appropriate, an agency spokesperson said in an email.

The spokesperson added that state Medicaid programs would be required to cover Wegovy for its new cardiovascular use. By law, Medicaid must cover nearly all FDA-approved medications, but weight loss treatments are among a small group of drugs that can be excluded from coverage. Around one in five state Medicaid programs currently cover GLP-1 drugs for weight loss.

Some of the nation’s largest insurers, such as CVS Health’s Aetna, cover those treatments.

But many employers don’t. An October survey of more than 200 companies by the International Foundation of Employee Benefit Plans, or IFEBP, found only 27% provided coverage for GLP-1s for weight loss, compared with the 76% that covered those drugs for diabetes. Notably, 13% of employers indicated they were considering coverage for weight loss.

Downstream health effects

The Food and Drug Administration approved Wegovy for weight management in 2021. In a landmark decision earlier this month, the agency expanded that approval after Wegovy was found to cut the risk of serious cardiovascular complications in adults with obesity and heart disease.

The decision was based on a five-year, late-stage trial, which showed that weekly injections of Wegovy slashed the overall risk of heart attack, stroke and cardiovascular death by 20%.

The approval demonstrates the significant downstream health benefits of Wegovy — and potentially similar drugs — for severe conditions caused by excess weight. Obesity increases the risk of several conditions, such as diabetes, heart disease and even some cancers.

It also challenges what some health experts call an “outdated” narrative driving hesitancy among some insurers: that weight loss treatments offer only a cosmetic rather than a medical benefit.

“We haven’t previously seen any anti-obesity medication decrease the risk of heart attack and stroke,” said Dr. Jaime Almandoz, a weight management and metabolism specialist at the University of Texas Southwestern Medical Center in Dallas. “What we have is proof that treating obesity is essentially life-saving, and I think it really shifts the conversation.”

An obesity patient takes a injection of weight loss medication.

Joe Buglewicz | The Washington Post | Getty Images

Some health experts argue that covering Wegovy and other GLP-1s for weight loss could reduce a plan’s health-care costs down the line and improve future health outcomes for patients.

Shawn Gremminger, the president and CEO of the National Alliance of Healthcare Purchaser Coalitions, said employers would be “well disposed to cover” those drugs if they are effective at lowering long-term costs. Members of that group represent private, public, nonprofit and union and Taft-Hartley organizations that spend over $400 billion annually on health-care.

But he said that it will likely take years before employers have access to concrete data on the potential cost savings of covering those treatments.

Gremminger added that employers are “a little bit less focused” on what covering weight loss drugs will mean for overall health-care spending 10 years from now. Their focus is on providing care to their current employees, some of whom will end up leaving the company down the line.

Employers have other questions, too, including about longer-term data on GLP-1s for weight loss, and about patients stopping those drugs prematurely. It also isn’t clear to some employers whether patients have to stay on Wegovy for the rest of their lives or if they can eventually taper off of it, Gremminger said.

Obesity and heart disease are chronic diseases, which means most patients will have to keep taking Wegovy along with diet and exercise to maintain the health benefits. Novo Nordisk said, “not unexpectedly,” data from their clinical trials shows that people who took Wegovy regained weight when they went off the drug.

“This supports the belief that obesity is a chronic disease that requires long-term management, much like high blood pressure or high cholesterol, for which most patients remain on therapy long term in order to continue to experience the benefits of their medications,” Novo Nordisk said in a statement.

But Gremminger said the standard of care for the long-term use of weight loss drugs is “in flux.”

Considering the costs

Faced with the dramatic cost of covering Wegovy and similar drugs, the state of North Carolina is paring back.

State employees will no longer have insurance coverage for GLP-1s when used for weight loss at the beginning of next month. In January, the board of trustees for the state’s health plan voted to exclude those drugs from coverage. The plan will still cover GLP-1s for diabetes, such as Novo Nordisk’s Ozempic, along with some older obesity drugs.

North Carolina’s treasurer and a GOP candidate for governor, Dale Folwell, told CNBC the expanded approval of Wegovy last week doesn’t change anything.

“We’ve never questioned the efficacy of the drug. We’ve always questioned what we’re having to pay for it,” Folwell said. “Even as the scope of the use of this drug widens, it doesn’t change the cost.”

North Carolina State Treasurer Dale Folwell attends the Republican Governors Association conference in Orlando, Florida, Nov. 16, 2022.

Phelan M. Ebenhack | AP

He said dropping weight loss drugs wasn’t a decision the board wanted to make, but it did so because the state’s plan is “under financial siege” due to Wegovy. That treatment cost the state’s health plan nearly $87 million last year, according to a state presentation from January. Overall, GLP-1 drugs for weight loss cost the plan roughly $102 million in 2023.

An outside consultant projected a $1.5 billion loss by 2030 if the state plan continued to pay for those treatments. North Carolina also estimated that continuing to cover GLP-1s for weight loss would double the premiums for all 482,000 active employees and dependents on the plan, even those not taking the drugs.

Folwell said the state has been working with Novo Nordisk and Eli Lilly, the maker of similar treatment Zepbound, to reach an agreement on costs. But he noted that the companies have rejected the state’s recommendations “at every turn.”

A spokesperson for Eli Lilly said the company is committed to working with health-care, government and industry partners “to help people who may benefit from Zepbound access it, but obstacles to that goal still exist.” The spokesperson added that policies around insurance have “not caught up to science.”

Novo Nordisk said in a statement it urges Folwell and the state health plan to “put patients first” and reconsider the decision to drop weight loss drug coverage.

Novo Nordisk believes “denying patients insurance coverage for important and effective FDA approved treatments for obesity is irresponsible,” according to a company spokesperson, who said the company will continue to engage with state health plan officials to address any potential cost concerns.

Both drugmakers have launched programs to help patients, with or without commercial insurance coverage, afford their weight loss treatments.

Novo Nordisk says its savings program can help patients without insurance coverage save up to $500 per 28-day supply of Wegovy. The company also said roughly 80% of Wegovy patients in the U.S. with commercial coverage for the drug are paying $25 per month or less.

List prices of weight loss drugs before insurance

- Wegovy from Eli Lilly: $1,059.87 per monthly package

- Zepbound from Eli Lilly: $1,059.87 per monthly package

- Saxenda from Novo Nordisk: $1,349.02 per monthly package

Increased competition in the weight loss drug market could force the two companies to drive down the costs of their injectable treatments, said Ceci Connolly, CEO of the Alliance of Community Health Plans. The organization represents regional, community-based health plans that cover more than 18 million Americans across the U.S.

Health plans may also be more open to covering convenient and potentially cheaper oral versions of the drugs, which several drugmakers are racing to develop. Those cheaper options, though, are likely still years away. That includes cheaper generic versions of existing GLP-1s, along with treatments from rival drugmakers.

Coverage with cost controls

More employers will likely start considering coverage of Wegovy following its expanded approval, according to Julie Stich, vice president of content at IFEBP.

But the plans that decide to include Wegovy when they next update their formularies will likely consider implementing certain requirements to control costs. Those requirements will look different for Wegovy’s two approved uses.

Most employers that cover GLP-1s for weight loss already use cost controls, according to the October survey by IFEBP.

Nearly a third of companies said they used “step therapy,” which requires their members to try other lower-cost medications or means of losing weight before using a GLP-1. Around 16% of employers used certain eligibility rules, such as requiring employees to have a certain BMI, or body-mass index, to receive coverage.

Fiordaliso | Moment | Getty Images

Other employers are using financial requirements, such as annual or lifetime spending caps for the treatments. For example, the Mayo Clinic’s employee health plan added a lifetime coverage limit of $20,000 for weight loss drug prescriptions filled after Jan. 1.

Meanwhile some players in the insurance industry are trying to find ways to help health plans manage the costs of covering the treatments.

Last week, Cigna’s pharmacy benefits management unit said it will limit spending increases for GLP-1s to a maximum of 15% annually for employers and other health plans. Currently, some of the company’s clients are seeing spending for those treatments rise 40% to 50% annually.

If more health-care companies pursue similar efforts, their affiliated health plans could become more open to covering weight loss drugs “knowing that their risk will be limited in that way,” Stich said.