Drakula & Co. | Moment | Getty Images

1. Get an ‘immediate deduction’ from your IRA

One of the first options is a pretax individual retirement account contribution, according to Mark Steber, chief tax information officer at Jackson Hewitt.

“They’re still very popular and it’s just good planning,” he said.

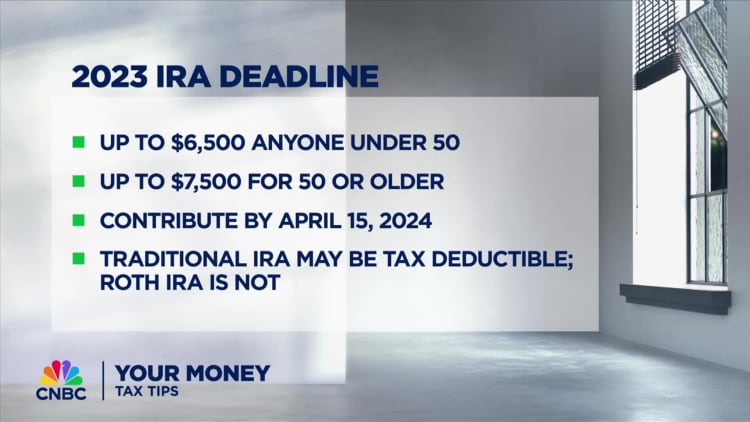

You have until the federal tax deadline for 2023 deposits, which could reduce adjusted gross income, depending on your earnings and workplace retirement plan participation. For 2023, you can save up to $6,500, with an extra $1,000 for investors age 50 and older.

“You get an immediate deduction” if you qualify, regardless of whether you itemize tax breaks on your return, Steber said.

Of course, you may also consider a 2023 Roth IRA contribution. That doesn’t offer the upfront tax break, but the money grows tax-free.

“Typically, if you’re in the 10% or 12% [tax] bracket, you’re probably better putting money into the Roth IRA,” Tommy Lucas, a certified financial planner and enrolled agent at Moisand Fitzgerald Tamayo in Orlando, Florida, previously told CNBC.

2. Save to an ‘underutilized’ spousal IRA

There’s also a lesser-known option for married couples filing jointly, known as a spousal IRA, which is a separate Roth or traditional IRA for nonworking spouses.

“They are underutilized,” said CFP Laura Mattia, CEO of Atlas Fiduciary Financial in Sarasota, Florida. “People don’t always think about them.”

Married couples can contribute up to the limit for each IRA, assuming the working spouse has enough earned income. Of course, you’ll need to weigh your short- and long-term situation, including possible tax consequences, before making any IRA contribution, Mattia said.

3. Add to your health savings account

You can also score a last-minute deduction with a 2023 health savings account contribution by the tax deadline, which offers a “multitude of benefits” — assuming you have a high-deductible health insurance plan, Steber said.

There are three tax breaks for HSAs: an upfront deduction for contributions, tax-free growth and tax-free withdrawals for qualified medical expenses.

You can deposit up to $3,850 for self-only coverage or $7,750 for a family plan for 2023. Investors age 55 and older can save an extra $1,000.