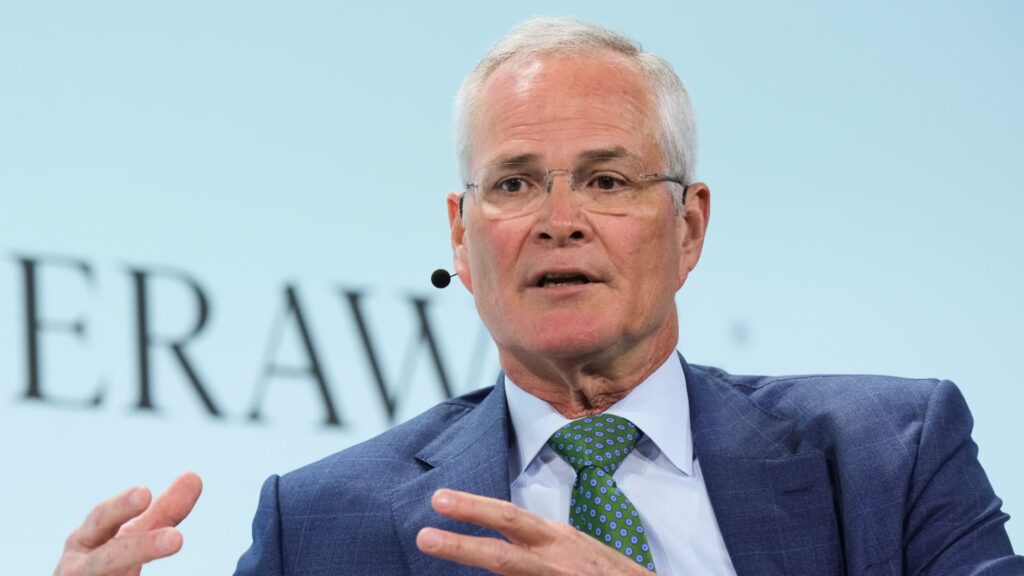

Darren Woods, chairman and chief executive officer of Exxon Mobil Corp, speaks during the 2024 CERAWeek by S&P Global conference in Houston, Texas, US, on Monday, March 18, 2024.

F. Carter Smith | Bloomberg | Getty Images

Exxon CEO Darren Woods said Monday that the dispute with Chevron over Hess Corporation‘s oil assets in Guyana likely will not be resolved until 2025.

“My view is it will go into 2025,” Woods told CNBC’s David Faber at the Milken Institute’s Global Conference in Los Angeles. Hess had previously indicated that the case could drag into next year.

“This is an important arbitration obviously not only for Exxon Mobil but for Chevron and Hess,” Woods said. “What we need to do is take our time to do what’s right to make sure that we do all the due diligence and we get to the answer — the right answer.”

Exxon is claiming a right of first refusal on Hess’ assets in Guyana under a joint operating agreement that governs a consortium that is developing the South American nation’s prolific oil resources. The oil major filed for arbitration in March at the International Chamber of Commerce in Paris.

Woods said the panel of arbitrators is still being selected and then the process will go into discovery. The CEO has repeatedly expressed confidence that Exxon will prevail in the dispute, saying Exxon wrote the agreement that governs the consortium.

Chevron has rejected Exxon’s claims that the agreement applies to its pending all-stock deal to acquire Hess, valued at $53 billion.

The arbitration court will ultimately decide the timeline of the proceedings, but Hess has asked the panel to hear the merits of the case in the third quarter with an outcome in fourth quarter. Chevron CEO Michael Wirth told analysts during the company’s first-quarter earnings call in April that this timeline should allow the companies “to close the transaction shortly thereafter.”

“We see no legitimate reason to delay that timeline,” Wirth said.

If Exxon prevails in the case, Chevron’s deal with Hess would break. Woods has said Exxon is not making a play to buy Hess, but wants to defend its right in the interest of shareholders and find out what value is being placed on Hess’ Guyana assets.

Hess has a 30% stake in an oil patch called the Stabroek block off the coast of Guyana. Exxon leads the project with a 45% stake while China National Offshore Oil Corporation maintains 25% stake.